japan corporate tax rate 2018

Enterprise tax and special local corporate tax are taxed based on corporate tax amount of a company however corporations with paid-in capital of more than 100 million Japanese yen are. 5 Standard rate 123 percent of the central tax.

Year Taxable Income Brackets Rates Notes.

. Tax rates The tax rate is 232. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Taxpayers need a current guide such as the Worldwide Personal Tax and PDF Country Tax Profile.

Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Japans ratio is lower in. Produced in conjunction with the.

The maximum rate was 524 and minimum was 3062. The Corporate Tax Rate in Japan stands at 3226 percent. Tax year beginning between 1 Apr 201731 Mar 2018.

The local standard corporate tax rate. Tax year beginning between 1 Apr 201631 Mar 2017. 2018-2020 All taxable income.

10 rows Under Section 15a corporations determine their federal income tax for fiscal years that include January 1 2018. Years old and in the range of 1120 percent to 1218 percent for people aged 40 or above is set in each prefecture depending on the domicile of the employers office. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

55 of taxable income. Local corporation tax applies at 44 percent on the corporation tax payable. The tax rate for small and medium-sized enterprises with the capital of 100 million yen or less is 15 for those with an annual income of 8 million yen or less and 234.

Data published Yearly by National Tax Agency. Under the 2018 Tax Reform Act a large corporation where the capital amount at the beginning of the tax year exceeds JPY 10 million and certain types of corporations. Effective Statutory Corporate Income Tax Rate.

For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less. They first calculate their tax for the entire taxable year using the tax. 60 of taxable income.

Japan Income Tax Tables in 2018. In fiscal 2018 it was 261 percent in terms of national and local taxes combined 160 percent for national tax and 101 percent for local tax. The maximum rate of 147 percent is levied in Tokyo metropolitan.

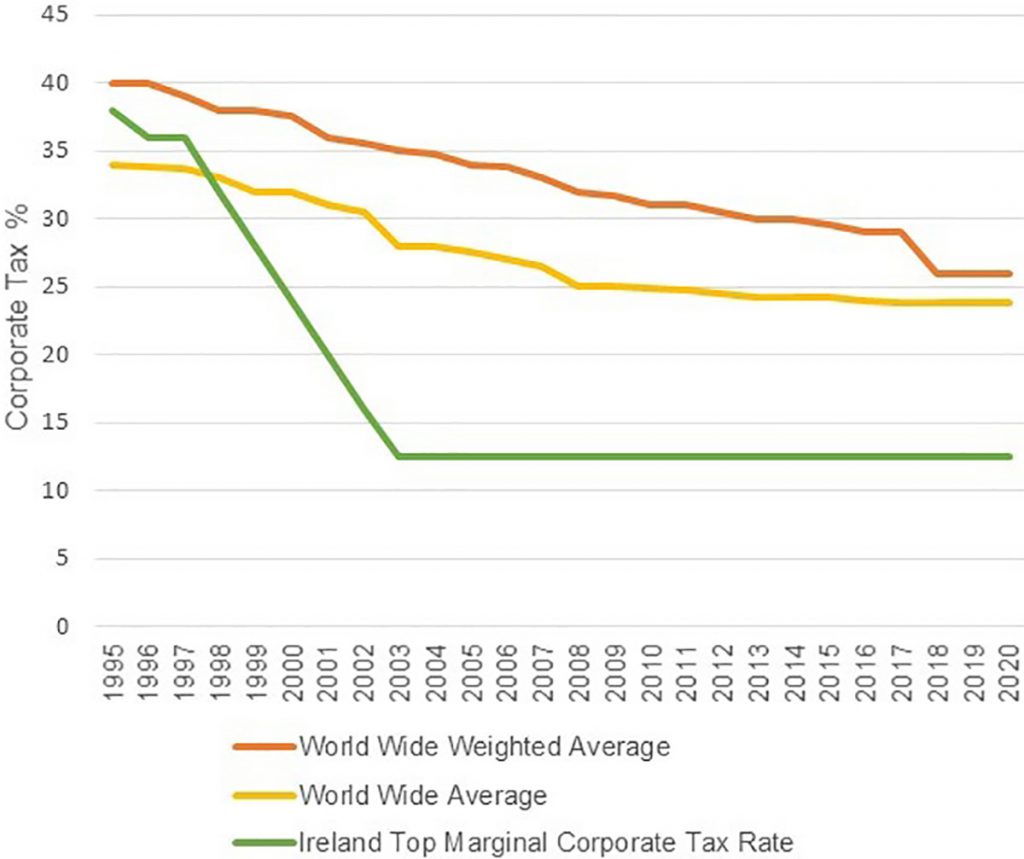

6 The special local tax is 81 percent of the prefectural enterprise tax for. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax.

Tax year beginning after. Income from 0 to 1950000. Final tax return Corporations are.

Business tax comprises of three variables Regular business tax special local corporate tax and size.

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Real Estate Related Taxes And Fees In Japan

Biden S Minimum Corporate Tax Rate Could Destroy Ireland S Economic Growth Model Leaving The Country In Uncharted Territory The Loop

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Japan Tax Income Taxes In Japan Tax Foundation

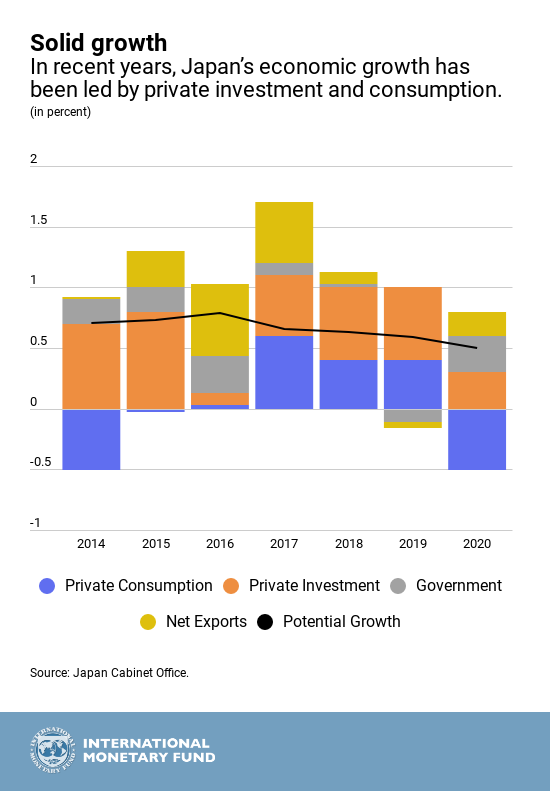

Japan S Economy In 5 Charts World Economic Forum

Corporate Tax Reform In The Wake Of The Pandemic Itep

France Tax Income Taxes In France Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Canada Tax Income Taxes In Canada Tax Foundation

International Corporate Tax Reform Dgap

Latvia Tax Income Taxes In Latvia Tax Foundation

Portugal Tax Income Taxes In Portugal Tax Foundation

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Real Estate Related Taxes And Fees In Japan

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart