harrisburg pa local services tax

8391 Spring Rd Ste 3 New Bloomfield PA 17068. Individual Taxpayer Mailing Addresses.

The Prior Service Entrepreneur Veteran Entrepreneurship And Lean Business Start Up 2nd Edition Ebook In 2021 Starting A Business Entrepreneur Start Up

Whether you are a taxpayer making a payment or a public official looking for a collection solution for your community we are ready to.

. Harrisburg City SD Director. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. First theres the fact that the citys main employer the state government pays no property tax.

Earned Income Tax Regulations. Factories warehouses branches offices and residences of home-based employees. The LST for the city of Harrisburg Pennsylvania will decrease from 1066 to 600 per pay period and the annual tax will remain at 156.

Making tax collection efficient and easy for over 35 years. Tax Credits and Incentives. This bulletin supersedes TAXES 16-35 Pennsylvania Local Service LST dated December 29 2016.

The name of the tax is changed to the Local Services Tax LST. Customarily this budgetary and tax levy-setting routine is accompanied by public hearings called to consider budget expenditure and tax questions. The minimum fee is 100.

Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the. The increase only applies to people who make more than 24000. Your Local Withholding Tax Rates HOME.

Local Services Tax forms for Individuals. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years. But in Harrisburg the situation is much more pressing.

Tax Return Preparation Accounting Services Bookkeeping Business Documents Records-Storage Management Tax Return Preparation-Business Taxes-Consultants Representatives 6023 Allentown Blvd Harrisburg PA 17112 Tel. Dauphin County Property Info. Tax Forms and Information.

The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from. Whether you are a taxpayer making a payment or a public official looking for a collection solution for your community we. Please make a selection from the menu below to proceed.

FAQ for Individual Taxpayers. Citizens have the right under state law to request a public vote should proposed tax hikes exceed set limits. Harrisburg lies on the east bank of the Susquehanna River.

We offer user-friendly online services coupled with responsive customer support to 900 school districts and municipalities throughout Pennsylvania. Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. Due Dates PDF Tax Types.

This is the date when the taxpayer is liable for the new tax rate. In setting its tax rate Harrisburg must adhere to the Pennsylvania Constitution. Local Services Tax forms for Individuals.

Dauphin County Office of Tax Assessment. Each payment is processed immediately and the date is equal to the time you completed the transaction. 2 South Second Street.

Pennsylvania Department of Community Economic Development Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA. This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online.

47 Home News. Monday - Friday from 800 AM to 430 PM. 8391 Spring Rd Ste 3 New Bloomfield PA 17068.

Harrisbarrig is the capital city of the Commonwealth of Pennsylvania in the United States and the county seat of Dauphin CountyWith a population of 50099 as of the 2020 census Harrisburg is the 15th largest city in Pennsylvania the 9th largest excluding townships and boroughs. Examples of business worksites include but are not limited to. Links for Individual Taxpayers.

A total of 156 a year to support the services I consume or might needroads police fire health inspections etcover some 2000 annual working hours seems like a fair price to pay. Harrisburg also received authority to raise the tax under Act 47 from the Commonwealth Court of Pennsylvania. Earned Income Tax Regulations.

A convenience fee of 235 for credit cards 250 for business cards and 150 for debit cards is charged. The tax which is deducted from the paychecks of people who work in the city is being tripled from 52 per year to 156 per year. Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47.

Pin On Everything To Know About Health Health Insurance

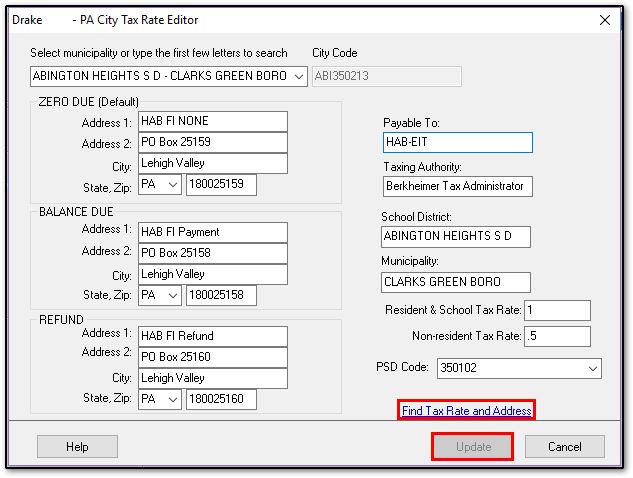

12242 Pa Splitting Tax Between School District And Municipality

Payroll Withholding Keystone Collections Group

Pin By Gojleroz On Biz Discipline Kids Parenting Books Toddler Good Sleep

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Police M113 A2 Police Tank Police Police Cars

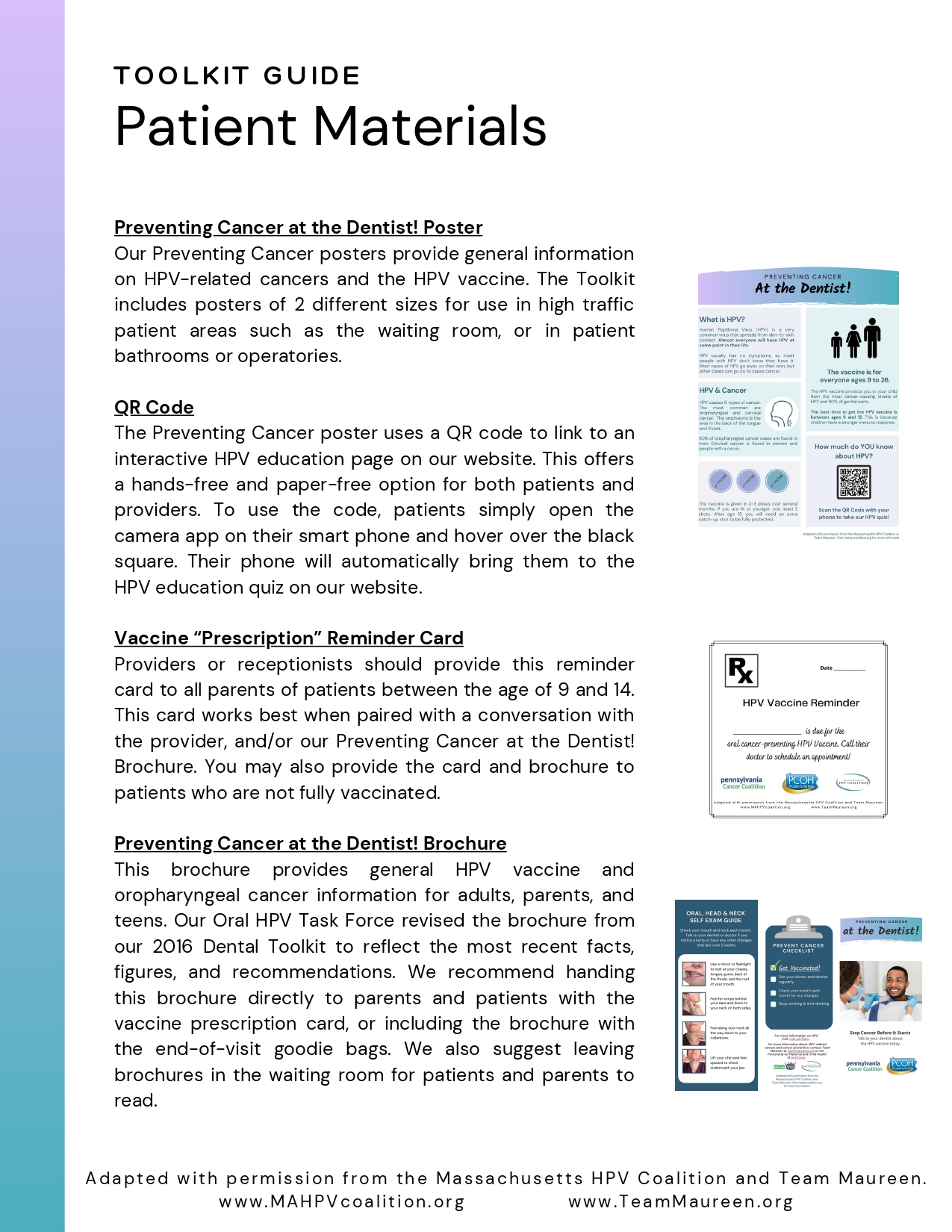

Materials Pcoh Pa Coalition For Oral Health

Pennsylvania Sales Tax Guide For Businesses

Us 734514 The Nicholson Bridge Also Called Tunkhannock Viaduct Nicholson Pennsylvania Usa Railroad Photos Railroad Bridge Railroad Art