www.tax.ny.gov.starcheck

For example to claim the STAR credit for 2020 you must register by April 15 2024. STAR is an ongoing initiative that provides qualified homeowners with school tax reductions.

Tax Exemption Deadlines Coming Up Next Week The Ithaca Voice

Income Tax Refund Status.

. To be eligible for Basic STAR your income must be 250000 or less. A department spokesman said it. Lf you purchased your house after 2015 and have applied with NYS to receive a STAR check you will receive a check in the mail.

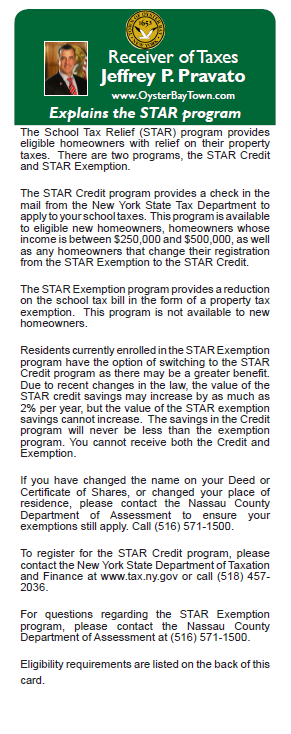

For other veterans benefits call your local New York State Division of Veterans Affairs office at 585 753-6040. The New York State Department of Tax and Finance has created a new website allowing homeowners to search for STAR check mailing dates. The average benefit is 790 for basic star and 1381 for enhanced star.

This credit is in addition to what New Yorkers may be eligible for via the STAR program School Tax Relief. You can view and print the following information regarding your 2017 through 2021 property tax credit checks that have been issued. If you are using a screen reading program select listen to have the number announced.

The Total payments amount from the return you. Enter the security code displayed above. Your prior-year New York State income tax return Form IT-201 IT-201-X IT-203 or IT-203X filed for one of the past five tax years and.

The state is sending out a one-time homeowner tax rebate credit HTRC to eligible residents worth up to 1050. Choose the county you live in from the drop-down menu. For residents of the Skaneateles.

Eligible New Yorkers are receiving a one-time homeowners tax rebate. So if I paid 3000 in real estate taxes portion of my annual maintenance which went to pay real estate taxes and I received an annual STAR credit of say 1500 I can only deduct 1500 as real estate taxes. Enter the security code displayed below and then select Continue.

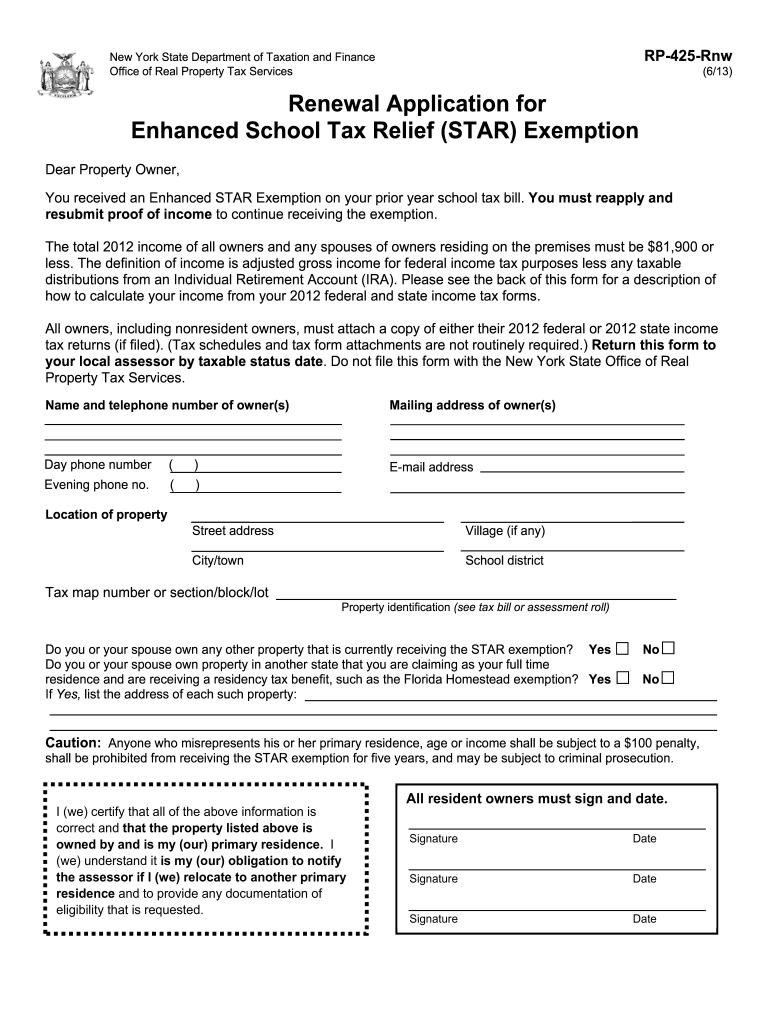

You currently receive Basic STAR and would like to apply for Enhanced STAR. Select your school district to view the information for your area. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM.

For those of you who wonder about real estate taxes and co-ops each month our maintenance is reduced by monthly pro-rated star credit. This check is only for people who bought their homes after mid-2015 people who make between 250000 and 500000 and others who chose to have the state tax department handle their STAR accounts. The basic STAR credit.

Do I need to register every year. The station representative that can assist any person with disabilities with issues related to the content of the public file is Maryann Ryan. The STAR Check Delivery Schedule lookup provides the most recently updated information available for your area.

HOMEOWNERS in New York are getting a bit of relief in the form of direct payments right now. The following security code is necessary to prevent unauthorized use of this web site. The benefit is estimated to be a 293 tax reduction.

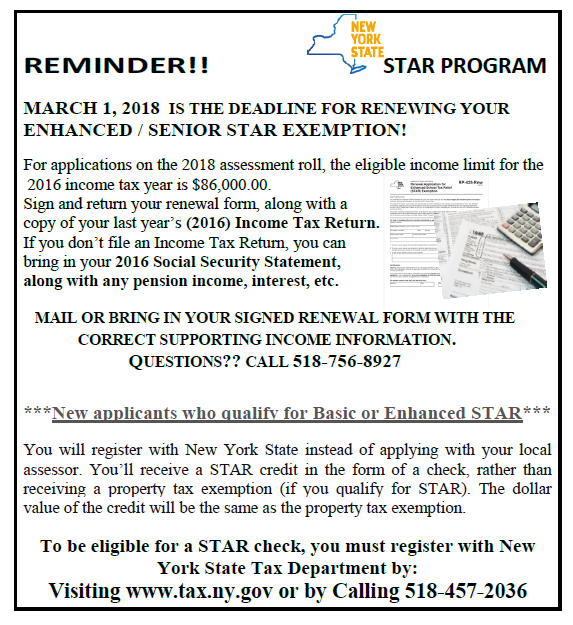

Basic STAR is for homeowners whose total household income is 500000 or less. WNYT Public File WNYA Public File FCC Reports. An existing homeowner who is not receiving the STAR exemption or credit.

The state has so far mailed more than 303000 checks a tax department spokesman said. While the website does not specifically advise when a check will arrive it provides notice of when checks have been mailed to homeowners in individual school districts. To qualify for this exemption.

8 hours agoNew York has begun mailing out its 2022 homeowner tax rebate checks several months earlier than originally planned. If you qualify you dont need to do anything. Enhanced STAR is for homeowners 65 and older.

If you are already receiving the STAR credit you do not. For homes bought after 2016 you pay the full property tax bill and then get the STAR as a check from the state. If you did get the STAR check you need to reduce your property tax deduction in the federal part of the program by the amount of the rebate you received in addition to answering the question in the state form.

Lf you have applied for the STAR check and are eligible but still have not received your check you may check the status of your check with. Hochul announces rebate checks for property taxpayers just ahead of primary. STAR helps lower property taxes for eligible homeowners who live in New York State school districts.

The homeowner tax rebate credit is a one-year program providing direct property tax relief to nearly three million eligible homeowners in 2022. Well automatically send you a check for the amount of your credit. Weve already started mailing checks and expect to mail most in June.

If you are using a screen reading program select listen to have the number announced. A senior who may be eligible for the Enhanced STAR credit. If you are using a screen reading program select listen to have the number announced.

Property Tax Credit Lookup. Select your town or city. DISABILITY - the New York State Real Property Tax Law allows local governments the option of granting a reduction in the amount of property taxes paid by qualifying persons with disabilities.

Enter the security code displayed above. Enter the security code displayed below and then select Continue. The state Department of Taxation and Finance is mailing out more than 130000 STAR checks throughout the state.

STAR Check Delivery Schedule. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply. There are two types of STAR benefits depending on household income.

To use the lookup. The total income of all owners and resident spouses or registered domestic partners cannot. The average benefit to New York City residents will be 425 and will be around 970 outside of New York City.

Most residents have reported receiving their checks over the last two weeks. The following security code is necessary to prevent unauthorized use of this web site. The timing of Gov.

Registrations will be accepted for three years from the income tax filing deadline for the year that the credit covers. Select Delivery Schedule lookup below. There are two types of STAR.

This credit is in addition to what New Yorkers may receive under the. However the sooner you register the sooner you will receive your STAR check. And the check stub includes a short message that starts Governor Hochul and.

If you are using a screen reading program select listen to have the number announced. Kathy Hochuls homeowner tax rebate check announcement has critics wondering whether shes. Low-income homes earning less than 75000 will.

09 13 21 Assessment Community Weekly

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Rebate Checks Are Coming What To Know This Year Wgrz Com

Tax Exemptions Town Of Oyster Bay

Star Property Tax Exemption Form Fill And Sign Printable Template Online Us Legal Forms

New York S Star Rebate Program Undergoes Changes

Register For The School Tax Relief Star Credit By July 1st Greene Government

The School Tax Relief Star Program Faq Ny State Senate

New York State Sales Tax Login Tax Ny Gov File Online New York State Tax State Tax

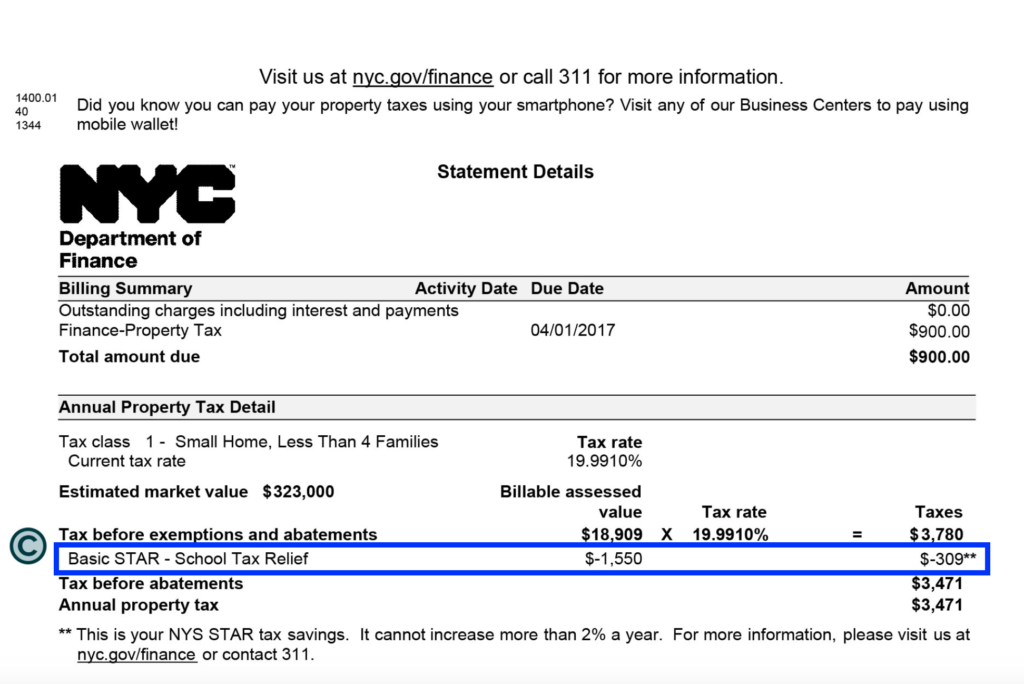

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Did You Get Your Tax Rebate Check Yet Here S How Many Still Haven T Hit Mailboxes Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

Star New York State Department Of Taxation And Finance Facebook